10 New Brand Metrics for FMCG

One of my previous posts, ‘Measuring the Irrational’, covered the theoretical implications of accepting that people are essentially irrational beings and that brands are irrational constructs. The following brand measures have been developed as a practical next step, they are largely new in approach, but do incorporate metrics that are already in existence. I have to confess, that 2 of the 10 metrics are not new at all, but work to compliment the other 8.

The following metrics have been conceived for a generic FMCG brand looking to gain (or re-gain) iconic status. A familiar, but tough, brief.

The brand in the mind

I believe that the difference between the subjective impressions of a brand can be compared with objectives ones to indicate brand strength in the consumer’s mind. By creating indexes of subjective vs. objective measures, and assessing them vs. competitors over time, we can measure and track the intangible power of a brand in the consumer’s mind.

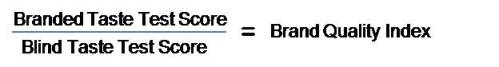

1. Perceived Quality

Numerous studies and meta-analysis have linked financial success of a brand to perceived brand quality, but how can we measure this and what is it in relation to? From psychological experiments to ‘the Pepsi challenge’, there are plenty of examples of brand effect on subjective experience, e.g. taste. By comparing blind and branded taste test scores, one can create a ‘brand quality index, which measures the extent to which the brand enhances (BQI>1), or detracts >

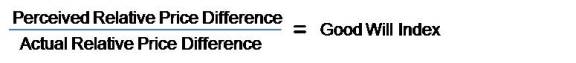

2. Good Will

Comparing perceived relative price difference to actual relative price difference will provide an index that indicates how much the brand is valued above what is normally paid for it. This is not a measure of price elasticity, it can be used to give a positive (PRPI>1) or negative >

3. Brand Fame (popularity)

Brand ‘fame’ or popularity has been established as both a profitable communications strategy, but also a reliable indicator of a brand’s financial success. Asking consumers ‘how many people out of 10 do you think use this product’ establishes a consumer perception of popularity. This can be compared to actual popularity (penetration used as proxy) to give a ‘brand fame index’. The brand fame index will measure the extent to which the brand is more (BFI>1) or less >

The brand in the market

What we say, think and do can sometimes be completely different, behavioural measures are needed to provide an accurate picture of how a brand effects consumer behaviour. Again, all measures should be assessed over time and compared with competitors.

4. Purchase Behaviour

Purchase behaviour (frequency, weight and penetration, the latter being most important) can provide an important indication of brand’s financial success or weaknesses. However, past purchase behaviour does not always predict future success. Claimed purchase intent alone is subject to a different kind of problem, it tends to be a measure of past behaviour, rather than a predictor of future behaviour. By comparing claimed, with actual behaviour, we not only understand how people are currently buying, we also gain an indicator of the direction purchase behaviour is moving in.

5. Devotion

Loyal customers may buy the brand ‘most of the time’, but the really devoted ones will only ever buy the brand, even if this means foregoing the category we’re out of stock. The Devotion Index will give an indication of the number of buyers who are well and truly bonded to our brand.

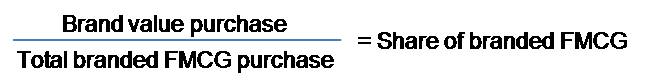

6. Share of branded goods

The recession in the UK has seen the branded FMCG goods sector decrease as value seeking consumers down trade to own label products. This means that substitution now occurs across categories as consumers seek limit branded purchases in an effort to reduce the total shopping bill. The total value share of the brand’s products as a proportion of all branded FMCG purchases will give us an indication of the overall strength of the brand that will not be effected by recessionary factors.

The brand at the bank

7. Price Elasticity

The extent to which sales rise or fall given a 1% price increase, when compared to competitor brands this measure can provide a powerful indicator of band strength that is directly linked to financial success.

8. Campaign Efficiency

Movements in share of market (SOM) are directly correlated with movements in share of voice (SOV) at a category level. This allows us to make market share predictions given our media spend. However, strong brands enjoy greater campaign efficiency, i.e. they exceed the predicted SOM growth given SOV. The Campaign Efficiency Index gives a proxy for the strength of the brand based on more than expected movements in SOM given our SOV.

9. Brand Valuation

Discounted Cash Flow

The objective of building a sting brand is to increase its profitability. The long term health of the brand will therefore be measured by its long term contribution to the bottom line. This will be assessed using the discounted cash flow (DCF) method.

Iconic Status

10. Getting into Mark’s and Spencer’s

Marks & Spencer is to break with 85 years of tradition by stocking brands other than those with an M&S label. Although the distribution gains achieved by meeting this objective will not significantly impact upon business in the same way that distribution in the main supermarkets might, meeting this objective will confirm the brand has claimed (or reclaimed) its iconic crown.

This can be downloaded as a document, with references, here.

No comments:

Post a Comment